1 44 000 then the balance of the amount of the employees HRA which is Rs. Digital Invoicing and Interactive Quotes do not currently support tax exemption.

Malaysia Tax Different Types Of Sst In Malaysia Under Deskera Books

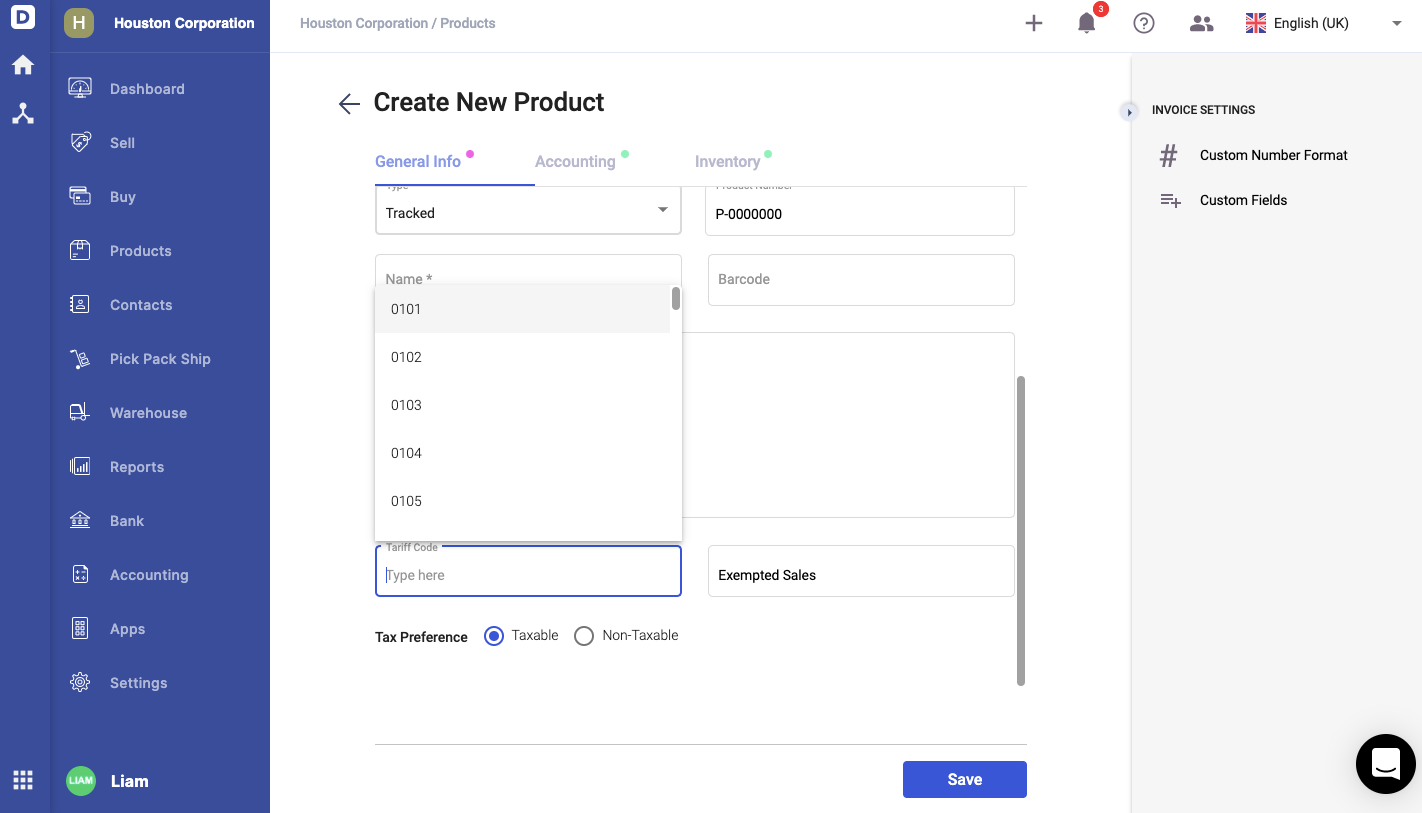

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

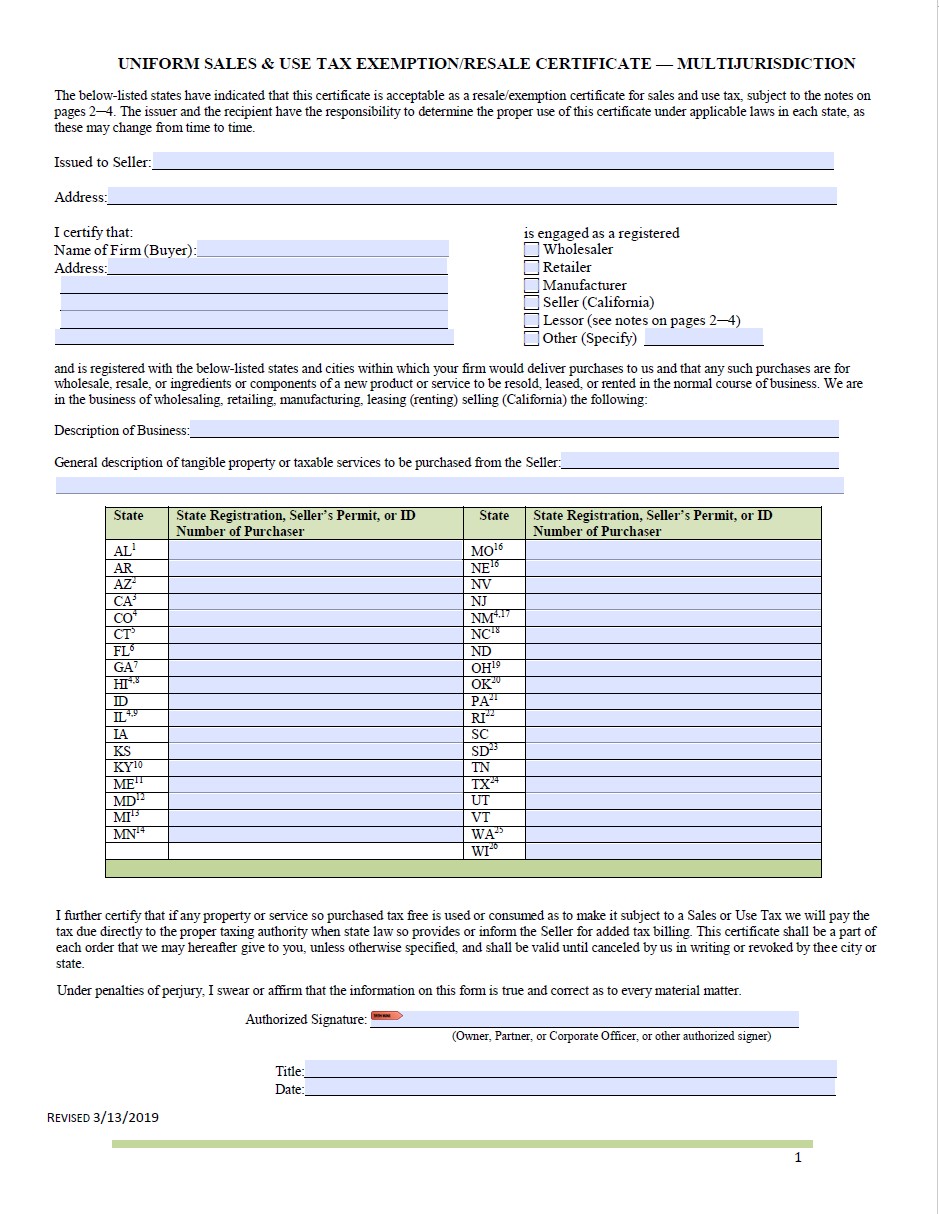

. Since the tax exemption which the employee in the example is getting is Rs. We will require some official documentation showing your organizations tax-exempt status and then grant the exemption. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax.

You then also bring along your wife to Australia. Vertex is the leading and most-trusted provider of comprehensive integrated tax technology solutions having helped 10000 businesses since 1978. SST Treatment in Designated Area and Special Area.

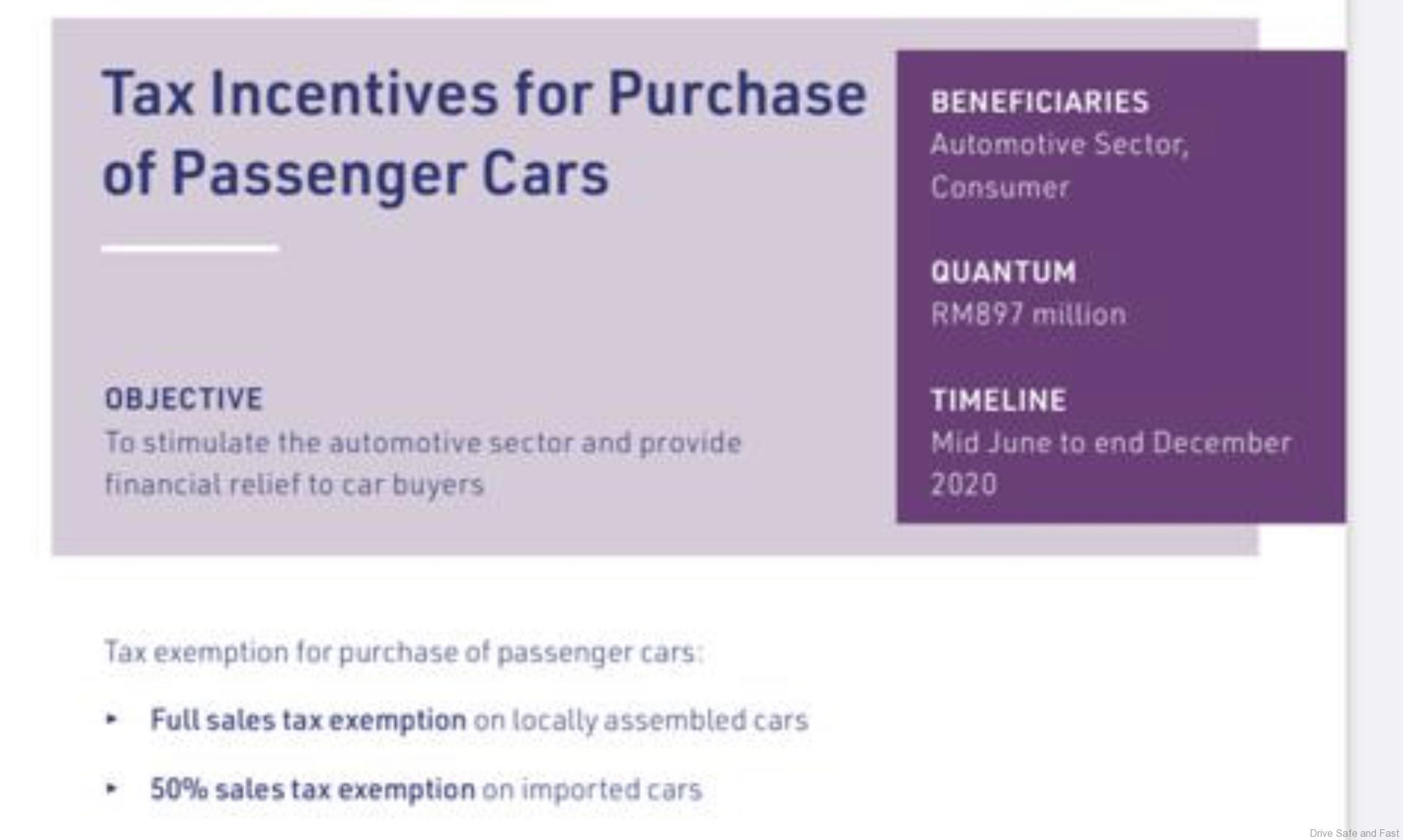

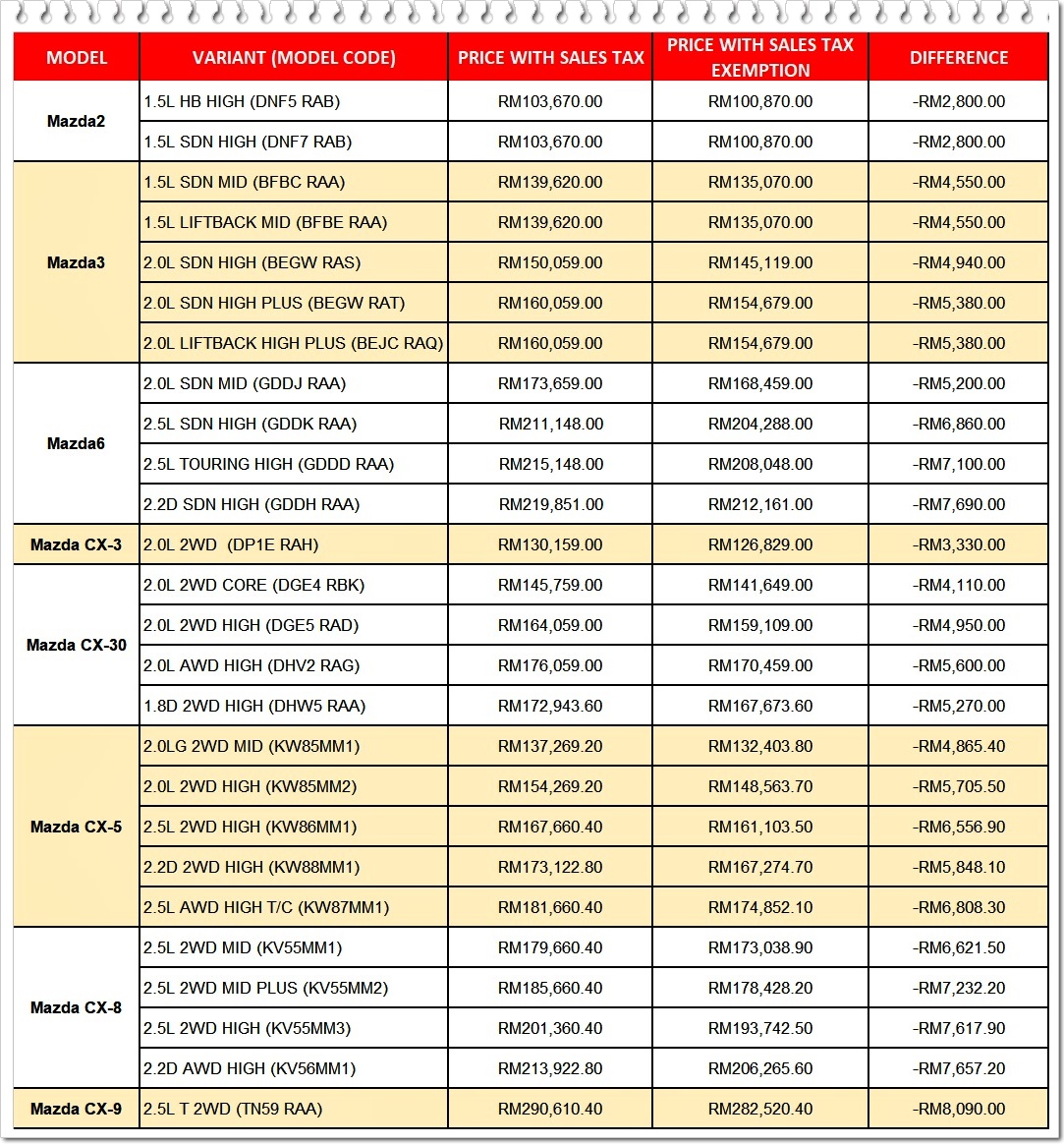

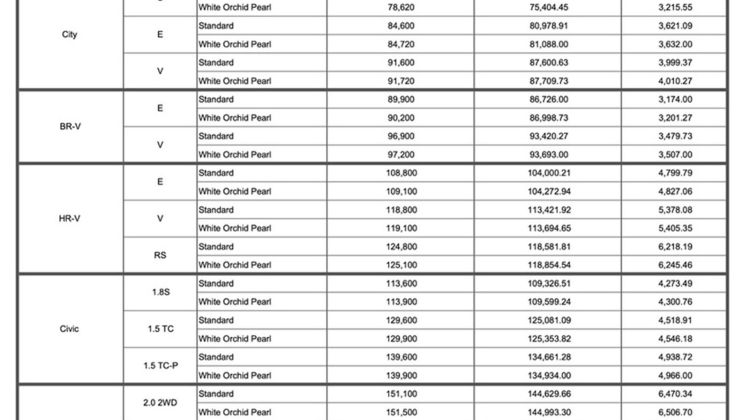

Sales tax in Malaysia is a single-stage tax imposed at the. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must check box D Foreign Diplomat and include the number displayed beneath the photo on their tax exemption identification card. On a year-on-year basis Malaysias vehicle sales jumped more than six times from 7499 units in July of 2021.

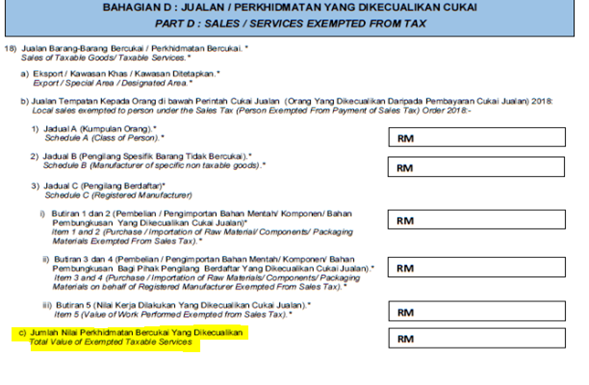

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia. Now we move on to the net chargeable gain. However sales tax is not charged on goods and manufacturing activities exempted by Minister of Finance under Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Person Exempted From Payment of Tax Order 2018.

When reaching out to us please provide your organizations tax-exempt documentation in your initial message. Malaysias vehicle production on the other hand soared close to 19 folds to 52061 units in July from 2775 units a year ago. Explore sales and use tax automation.

Outsource administrative tasks to trusted experts in indirect tax and exemption certificate management. 12022 Pindaan No1 Malay Version ONLY More 02092022. At the same time the maximum tax exemption per employee is RM3000year.

MAA expects sales in August to be maintained at the July level. Dasar Cukai Perkhidmatan Bil. Malaysia Sales Services Tax SST Effective 1 st September 2018 Malaysia Airlines domestic routes will be subject to the Service Tax ST of 6.

Malaysia excludes designated area and special area. SST Deregistration Process. Abolishment of GST in Malaysia.

6 Order 2022 Exemption of FSI received by resident companies LLP and individual in relation to a partnership business in Malaysia Based on the Exemption Orders the following categories and sources of FSI received in Malaysia from outside Malaysia are exempted from tax from 1 January 22 to 31 December 2026. The proof of exemption such as valid Overseas Employment Certificate OEC Balik Manggawa BM document or other acceptable exemption documents shall be presented upon purchase of. This guide outlines the topics you need to know about sales and service tax SST in Malaysia.

The company will pay RM5000 for the sales person to attend a business tripconference which is deductible for business purposes. Lets start with how GST was abolished. Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018.

Facilities Under The Sales Tax Act 1972. A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. 96 000 is fully taxable at the. Tax Jurisdictions and Corresponding ID Numbers.

Assuming youre a sales manager who will travel to Australia to attend a trade conference. Consult our experts for end. Asia and the Pacific.

How to Check SST Registration Status for A Business in Malaysia. VAT and Sales Tax Table of Contents. Malaysia Sales Tax 2018.

Malaysia Service Tax 2018. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. If your tax-exempt organization was charged sales tax contact us for a tax refund.

Net Chargeable Gain Chargeable Gain - Exemption Waiver RM10000 or 10 of Chargeable Gain whichever is higher RM190000 - RM190000 X 10 RM171000. Manufacturers of specific non-taxable goods tax exemption on acquisition of raw materials components packaging materials and manufacturing aids to be used solely and. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight.

Disposed by him and on taxable goods imported into Malaysia. 100 tax exemption on QCE incurred within 5 years and this is to be used for a statutory income offset of 70 or 70 exemption on income tax for a. If the column reads Exemption does not apply on B2B tax exemption will remain unsupported in that jurisdiction.

As mentioned above we can deduct the exemption waiver. Income Tax Exemption No. The Schedule A of the Sales Tax Exemption from Licensing Order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding RM100000 are exempted from the requirement of applying for a sales tax licence.

Sales Tax Exemption From Registration Amendment Order 2022. Manufacturing activities which are exempted by Minister of Finance under Sales Tax Exemption From Registration Order 2018.

Iowa Nonprofit Sales Tax Exemptions Remote Sellers Gordon Fischer Law Firm

Are You Subject To Sales Tax In Malaysia How To Plan For Your Sales Tax Anc Group

Budget 2022 Car Buys Still Free Of Sales Tax Until June No Rpgt For Property Sold From Sixth Year

Sales Tax Exemption C1 C2 C3 Youtube

About Sales And Service Tax Sst In Malaysia Help Center Wix Com

Businessusetaxexemptform Motion Raceworks

M Sian Govt Extends Sst Exemption Until 31 December 2021

Sst Exempted Service Abss Support

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

Office Depot Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Revised Mazda Prices With Sales Tax Exemption From June 15 2020 News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate R Letter Example Resume Template Examples Cover Letter Template

Image 2 Details About Honda Cars Cheaper By Up To Rm 9 000 Due To Sales Tax Exemption Wapcar News Photos